A surprisingly common form of insurance fraud is a staged car crash. Known as ‘crash for cash’, these are pre-meditated, organised and/or staged traffic collisions which are another example of claim farming that is rife across many countries – including Australia.

Crash for Cash scams are a major threat for private motorists and for companies operating fleets, with the activity costing insurers hundreds of millions of dollars each year. These scams involve fraudsters deliberately crashing into the vehicle of an innocent motorist, another vehicle they operate, or submitting false claims for accidents.

This week we were delighted to hear from one of our customers – one of the UK’s top high-street retailers – who confirmed that prosecutions had been secured for a number of individuals involved in one such scam.

According to the anti-corruption unit of the Metropolitan Police in the UK, Microlise telematics and tracking data played a crucial role in demonstrating liability and securing the convictions.

What is Crash for Cash?

Crash for Cash scams are designed for fraudsters to make as much money as possible from false or exaggerated claims, which are based on intentionally crashing into the vehicles of victims. Typically claims will involve personal injury, both mental and physical.

There are three typical Crash for Cash scenarios:

- A Ghost Accident is where a fraudster will submit claims for accidents that did not actually occur

- An Induced Accident involves the fraudster driving in such a way as to ensure that an accident takes place, such as slamming on brakes unexpectedly so they are hit from behind

- A Staged Accident is where fraudsters deliberately crash two of their own vehicles together, or use tools to cause damage that they then claim is the result of an accident

What happened in this case?

In this instance, a staged accident was the scam type used. The driver of the home delivery vehicle was part of the convicted group, which more shockingly, also included a serving member of the UK Metropolitan Police.

After crashing into a car containing members of the fraudster group, the home delivery driver reported the accident to his employer on the basis he was at fault. The other members of the group then made injury claims, including severe pain, stiffness and discomfort, and anxiety.

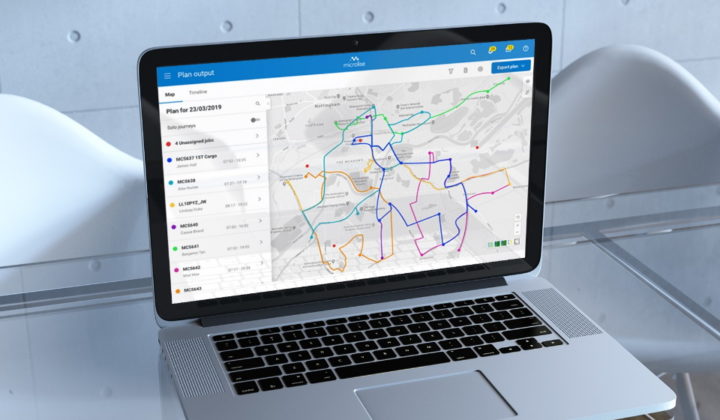

How Microlise telematics data supported our customer

As a Microlise customer, the fleet operator was able to analyse the incident in granular detail. Microlise’s Incident Data Recorder functionality, part of our Safety Module, provided visibility of what the driver was doing in the seconds before, during and following the recorded incident.

In this case, the data showed deliberate actions in causing the accident, as well as a lack of the sort of actions – such as sharp braking – a driver would typically engage in to avoid such a collision.

We were delighted to receive more first-hand proof of how telematics solutions can defend fleet operators from this current wave of malicious insurance activity.